Fifteen NGOs supporting the Insure Our Future campaign warn insurance CEOs of increasing public pressure on companies that do not end their support for coal, extending scrutiny to Asian and North American companies.

Dear Madam/Sir,

Since 2017, the organizations engaged in the Insure Our Future campaign have called on the insurance industry to stop underwriting and divest from the coal sector and to demonstrate their commitment to protecting their customers from dangerous climate change by bringing their businesses in line with the goals of the Paris Agreement more generally.

In the past two years we have seen encouraging progress with 11 major insurance companies – including the world’s largest primary and reinsurers – adopting policies to end or limit their insurance services for the coal industry. In addition, more than 20 major insurance companies have divested from coal.

While some of these policies fall short of best practice and many industry laggards remain missing in action, the policies adopted by leading insurance companies have had a welcome impact in accelerating the transition from coal to clean energy sectors. In its Power and Renewable Energy Market Review 2019 the broker Willis Towers Watson found that

“Insurers’ retreat from underwriting coal business has left coal-fired generators with a significant reduction in available capacity. (…) This reduction in available capacity will invariably see upward pressure on rates and coverages as the competition for market share in this specific sector will be much more limited.”

While this progress is welcome, the urgency of scaling up climate action is becoming ever more manifest. The IPCC’s 1.5 degrees report found in October 2018 that limiting average temperature increases to 1.5 rather than 2 degrees will result in “robust differences” in terms of fewer and less intense extreme weather events as well as droughts, floods and wildfires. It will also reduce impacts on sea level rise, species loss and extinction, public health and livelihoods, water and food security and economic growth.

According to the report limiting global warming to 1.5 degrees will require “rapid and far-reaching transitions” in all sectors which are “unprecedented in terms of scale”. All pathways analyzed by the IPCC show a “steep reduction” in the use of coal. Under the report’s middle-of-the-road scenario, combustion of coal needs to be reduced by 75% from 2010 levels by 2030, and by 98-100% by 2050.

Climate change is now affecting insurance companies’ customers and their own businesses. Insurers’ losses from natural catastrophes reached $140 billion and $80 billion in 2017 and 2018 respectively, significantly more than the (inflation-adjusted) 30-year average of $41 billion. Munich Re recently warned that climate change could make insurance cover unaffordable for ordinary people.

It has been more than 45 years since a prominent global reinsurance company first warned about the risks of climate change. Yet even today, many insurers continue to underwrite projects and companies which actively undermine the goals of the Paris Agreement. At this point insurance companies, like all other actors in society, must urgently scale up their actions to bring about the rapid and far-reaching transition to a low-carbon economy which the latest IPCC report called for.

At this stage we call on the insurance industry, including your company, to take the following actions:

- Immediately cease underwriting coal and tar sands projects and companies (unless they are engaged in a rapid transition process from coal and tar sands to clean energy that would normally take no longer than two years) across all lines of business. Workers compensation policies, which directly benefit workers in the coal industry, should be exempt from this policy.

- Immediately start divesting from coal companies and companies developing projects to extract and transport tar sands. Divestment should include your company’s own assets as well as assets managed for third parties (if applicable).

- Align all your business activities, including your underwriting and investments, with science-based targets that limit average global temperature increases to 1.5 degrees Celsius where they are applicable and other pathways where they are not. This will require a transition from all fossil fuels to clean energy projects and companies worldwide by 2050 in your underwriting and investments.

- Bring your stewardship activities (including the engagement with investee companies and exercise of voting rights), membership of trade associations and public positions as a shareholder and a corporate citizen more broadly in line with the goals of the Paris Agreement and create full transparency about these positions.

We ask you to inform us about the actions your company is taking by September 15, 2019.

As in the past two years your response will provide the basis for a scorecard report on insurance, coal and climate change that we will publish in November/December 2019. We will share detailed information about our assessment methodology with your sustainability staff in the coming months. This year we are expanding the number of companies we will assess and rank from 25 to 30.

We have also extended our timeline which we hope will allow for a thorough discussion and policy formulation process. Through our partners in the Insure Our Future campaign we will be happy to engage with your staff in this process in the coming months.

Along with the scientific evidence, public support for rapidly scaling up climate action is growing quickly, including undoubtedly among your customers and employees. The shift of insurers away from coal has been welcomed by voices such as the Financial Times and the UN Secretary General and is quickly becoming the benchmark for socially and environmentally responsible insurance companies.

We look forward to working with you to accelerate the insurance industry’s transition away from coal and tar sands. We will not hesitate to increase public pressure on companies which are not prepared to engage in this transition or undermine the progress which other companies have made.

Thank you for your personal interest in this matter. We will be happy to answer any questions you or your staff may have.

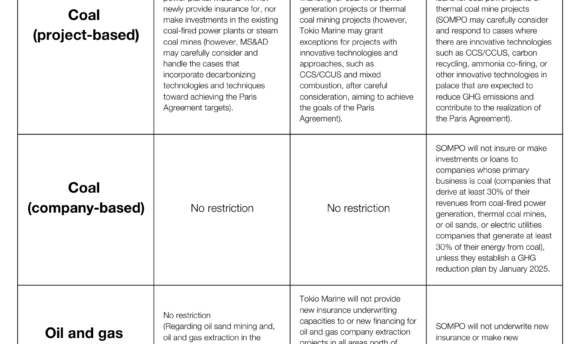

This letter is being sent to the CEOs of the following insurers: AIG, Allianz, Aviva, AXA, Axis Capital, W.R. Berkley, Berkshire Hathaway, Chubb, FM Global, Generali, Hannover Re, HDI, Legal & General, Liberty Mutual, Lloyd’s, Mapfre, MetLife, MS&AD, Munich Re, Ping An, Prudential, QBE, Samsung Fire & Marine, SCOR, Sinosure, Sompo, Swiss Re, TIAA Family, Tokio Marine, Zurich.

Yours sincerely,

May Boeve (350, Executive Director), Carmen Balber (Consumer Watchdog USA, Executive Director), Clara Vondrich (Divest Invest, Director), Jakub Gogolewski (Member of the Management Board Foundation Development YES – Open-Pit Mines NO, Poland), Florent Compain (Friends of the Earth France, President), Daniel Mittler (Greenpeace International, Political Director), Yuki Tanabe (Japan Center for a Sustainable Environment and Society (JACSES), Program Director), Julien Vincent (Market Forces, Australia, Executive Director), Alex Doukas (Lead Analyst, Stop Funding Fossils Program Oil Change International) Lindsey Allen (Rainforest Action Network, USA, Executive Director), Antonio Tricarico (Re:Common, Italy, Program Director) Kelly Martin (Beyond Dirty Fuels Campaign The Sierra Club, USA, Director), Joojin Kim (Solutions For Our Climate, Korea, Executive Director), John Hepburn (The Sunrise Project, Australia, Executive Director) Heffa Schuecking (Urgewald, Director).