Taka, once an insurance executive at the global insurer, AIG, is now heading a shareholder advocacy organization working to accelerate the transition to net zero greenhouse gas emissions. During Taka’s time as an insurance executive, he increasingly understood the impacts of climate change and became compelled to get involved in climate change activism.

In this interview, Taka explores his career journey and shares what inspired him to get involved in climate change activism.

A glimpse of Taka’s career:

- 1976 – Graduated university and joined AIU (an AIG subsidiary)

- 1987 – Transferred to the Finance Department

- 1990 – Became Head of Finance at AIU

- 1992 – President of American Home (an AIG subsidiary)

- 1997 – Launched Japan’s first direct sales of auto insurance.

- 2000 – President of AIU

- 2006 – President of American Home

- 2010-2017 – President of Fuji Fire and Marine (an AIG subsidiary)

- 2019 – Director of 350 Japan

What inspired you to get involved in climate activism?

When I started working in the 1970s, environmental pollution like the Minamata disease and air pollution in Yokkaichi was discussed as a major social issue. I knew working in manufacturing, for example, had the risk of exposure to pollution, so I chose to join the insurance industry.

I have always been interested in environmental issues and continued to study independently after joining AIG. I was actively involved in charity work, organizing charity concerts to raise funds for the United Nations High Commissioner for Refugees (UNHCR), and applying for the Japan Overseas Cooperation Volunteers, etc. Unfortunately, I had less time for social activities as I became busier with my career.

One day, a colleague said, “To be a respectable member of society, you need to fulfill three responsibilities: to your family, your job, and society”. This made me realize that I may have done well in my career and family life but may have neglected my social responsibility.

Around this time, I read This Changes Everything: Capitalism vs. the Climate by Naomi Klein and was deeply moved. Since 350.org was mentioned in the book, I called the 350 Japan office and started volunteering in 2018. Later, when Shin Furuno, the director of 350 at that time, was appointed as the Asia Regional Director, I was encouraged to apply for the director position.

You started as a volunteer and rose through the ranks to the director of 350 Japan!

Yes, but it was challenging because I lacked experience in the NGO sector. I thought I had read many books about climate change, but there was still a lot I needed to learn.

What led you to focus specifically on climate change among other environmental issues?

I’ve been concerned about climate change since The Limits to Growth was published. When I worked in the insurance industry, I felt the impact of climate change in various ways. Fire insurance was historically considered a highly profitable product but was becoming less profitable towards the end of my career. Not only did natural disasters like floods and wind damage affect the company’s performance, but they also made me aware of climate change.

So the impact of climate change was noticeable for people in the insurance industry at that time.

Yes, but Japanese companies were very slow to respond. At the time, Japan’s insurers were focused on sales, operating under the mindset that more disasters meant more insurance sales. The sales divisions had power within these companies.

In contrast, American companies, driven by profitability, took measures against climate change. I think this difference reflects the cultural gap between Japanese and American companies. Especially when it comes to matters like coal-fired power, public pressure is much stronger overseas.

What do you think is the role financial institutions play in addressing climate change?

Japan faces a significant challenge with its high dependence on coal, the most GHG-intensive energy source. Many major Japanese banks have historical ties with energy companies, so they provide funding through loans.

We believe that by pressuring banks to withdraw financial support from the fossil fuel industry, we can end fossil fuel-based power generation. Recently, we’ve started seeing some progress, with Japanese banks finally tightening their policies. I believe the combined pressure from grassroots movements and shareholder proposals made this possible.

How does the role of insurance companies differ from that of banks in tackling climate change?

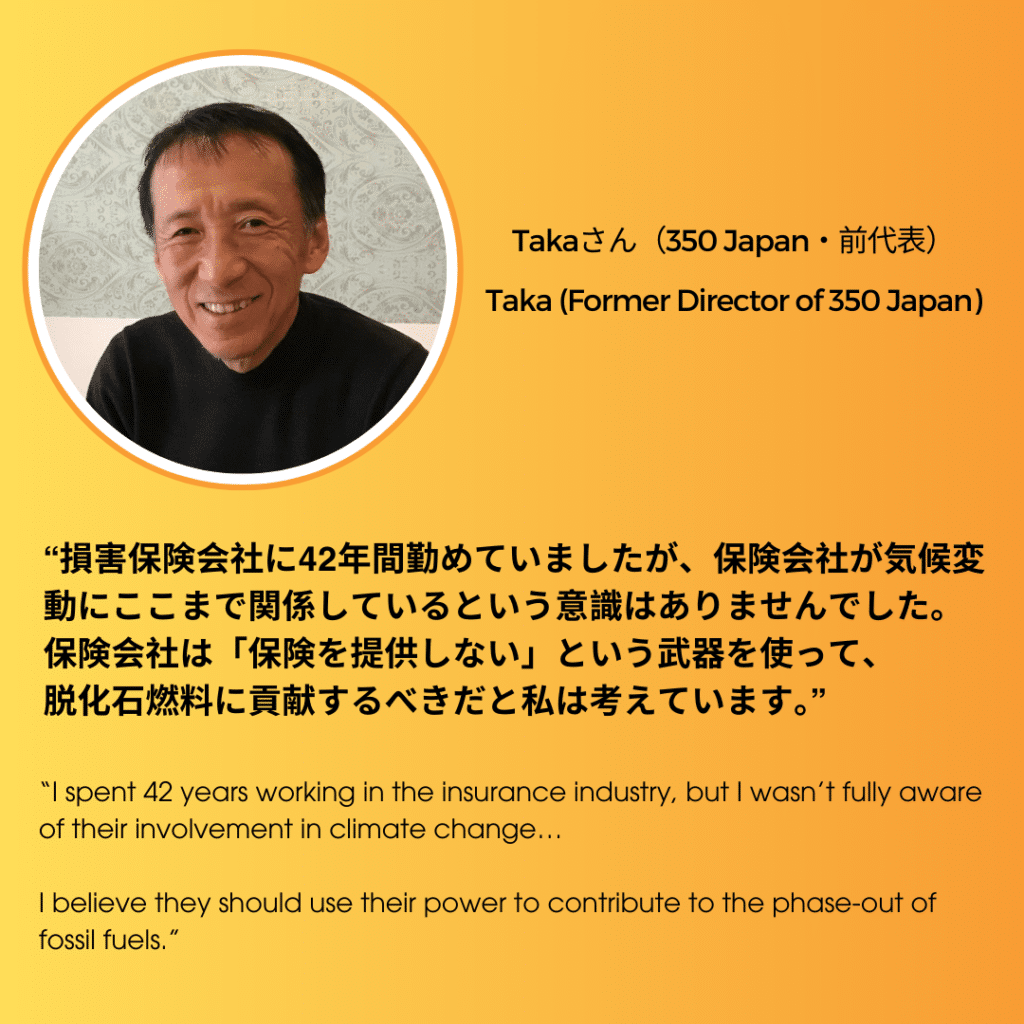

I spent 42 years working in the insurance industry, but I wasn’t fully aware of their involvement in climate change. It wasn’t until I spoke with Peter Bosshard, the former Program Director of Insure Our Future, that I realized the role they play.

Life insurance and non-life insurance differ in the roles they play. Life insurance, due to its significant assets, has the power to mitigate climate change through its investment choices. Non-life insurance companies may have a smaller influence as asset owners, but they possess a powerful tool: the ability to refuse to provide insurance. If they stop underwriting insurance for coal-fired power plants, those plants would be unable to operate, as companies wouldn’t risk running them without coverage.

In addition, with the increase in natural disasters caused by climate change, non-life insurers face the risk of higher claims, leading to potential losses. This creates a strong incentive for them to take action against climate change to protect their profitability. I believe they should use their power to contribute to the phase-out of fossil fuels.

It’s sad to see AIG score so poorly on Insure Our Future’s scorecard. I even emailed my former boss, the CEO of AIG at the time, urging him to stop providing insurance for Adani’s coal mine in Australia.

What do you think is needed to raise more awareness about the role of insurance companies in climate action in Japan?

Historically, Japanese people tend to view climate change as an “unavoidable” natural disaster. Japan has always had frequent natural disasters, so people are somewhat accustomed to accepting annual typhoons and such. The public is yet unaware that climate change is caused by human activity and can be solved by humans.

At 350 Japan, we offer programs to learn the basics of climate change to help people understand the issue. While some people have strong awareness and interest, I feel that overall awareness is still lacking in Japanese society. I hope the climate change classes will help more people get involved in climate change activism.

What are your plans moving forward?

I will always stay involved in climate change activism. It’s such a significant issue that we can’t just turn a blind eye.

With that being said, the way I am involved may not stay the same. 350.org was originally founded by American students and focuses on people in their late 20s to 50s, and I believe people in this age group should take leadership. I plan to step down from my full-time role* since I’m turning 70 this year. There is a new cross-sectional NGO project launched, so I plan to stay active there.

*This information is as of the time of the interview.