Organizations with 76 million members warn project would have disastrous impact on climate change

73 organizations, representing a combined membership of more than 76 million people, are sending an open letter to 30 global insurance companies today, calling on them to publicly rule out any insurance services for Adani Group’s Carmichael coal mine and associated rail project in Queensland, Australia.

The letter was announced at a press conference at COP24, the U.N. climate talks here. It calls on insurance companies to refrain from insuring the project — and Adani as a whole, so long as they are proceeding with the Carmichael mine — in light of its potential climate, social, and broader environmental impacts. It asks them to respond by Friday, December 14, after which the coalition will make public the commitments it has received.

The Carmichael coal mine is arguably the most environmentally and socially contentious project in Australia’s history. The project consists of a major thermal coal mine and an approximately 200 km long rail line. Coal burned over the approved lifetime of the mine would produce 4.6 billion tonnes of CO2emissions, which is equivalent to more than eight years of Australia’s annual greenhouse gas emissions. Developing the mine would open up the huge reserves of Queensland’s Galilee Basin to exploitation.

The rail line would transport the coal to an export terminal on the Great Barrier Reef. The resultant dredging and ship traffic poses threatens irreversible damage to one of the world’s most biodiverse ecosystems, a global treasure that is under protection as a World Heritage Site.

In addition to being a carbon and environmental disaster, the mine would be built on the lands of the Wangan and Jagalingou Traditional Owners, who continue to oppose the project.

Adani has tried to raise bank financing, but 37 global financial institutions, including all Australia’s major banks, have publicly rejected any involvement. On November 29, the company announced plans to self-finance the entirety of the Carmichael mine and rail line, a US$1.5 billion project. This leaves insurance as a critical missing piece of financial support for the project.

Seven leading insurers have already announced that they will not insure new coal mines and plants: Swiss Re; Generali; Zurich; Allianz; AXA; SCOR; and Munich Re. However, many major companies continue to insure new coal projects, including U.S. insurers AIG, Berkshire Hathaway, Chubb and Liberty Mutual, Australian insurers QBE and Suncorp, the Talanx subsidiary HDI, and the reinsurer Hannover Re. And the seven insurers who have pledged not to insure new coal projects have not all committed to withdrawing cover for the infrastructure they rely on, such as rail links.

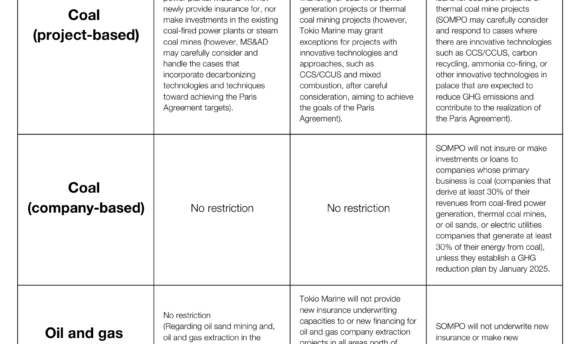

The companies written to are Suncorp Group and QBE insurance in Australia; Hamilton Insurance Group in Bermuda; AXA and SCOR in France; Allianz, Hannover Re, HDI and Munich Re in Germany; Generali in Italy; Sompo and Tokio Marine in Japan; Mapfre in Spain; Chubb, Swiss Re and Zurich in Switzerland; Beazley, Canopius, Chaucer, CNA Hardy, Lloyd’s, and insurance broker Marsh in the United Kingdom; and AIG, Axis Capital, Berkshire Hathaway, FMO Global, Great American Insurance Group, Liberty Mutual, the Markel Corporation, Starr, and W.R. Berkley in the United States.

The letter has been coordinated by Australian NGO Market Forces, US NGO Rainforest Action Network, and the international Insure Our Future campaign, with Greenpeace, Japan Center for a Sustainable Environment and Society, Re:Common and urgewald. The 73 signatories also include 350.org, the Australian Youth Climate Coalition, Divest Invest, and Friends of the Earth International.

"The world’s insurers must follow the banks’ lead and publicly rule out any insurance services for the mine’s construction and operation. Young people across Australia are watching. More than 15,000 youth walked out of school last week, demanding that governments take action on climate change and oppose the dangerous Adani mine.”

"Insurance companies are facing an existential threat from climate change, so they should be lining up to rule out support for a project that would open up one of the world’s largest untapped coal reserves. With Adani claiming to fund the Carmichael project itself, it could be the decision of a major insurer that decides whether this climate-wrecking project goes ahead.”

"Adani’s plans show contempt for the Paris Agreement and its goal of limiting global warming to 1.5C, but they cannot go ahead without insurance. It is time for insurers to put their money where their mouth is and publicly rule out providing any services for the Carmichael carbon bomb.”

"It is outrageous that major US insurers such as AIG, Chubb and Liberty Mutual continue to ignore the progress being made by their European peers in phasing out support for coal. We can wave goodbye to the chances of staying under 1.5°C if the US insurers treat the European insurers’ retreat from coal as an opportunity for them to ramp up business and insure projects like Adani.”