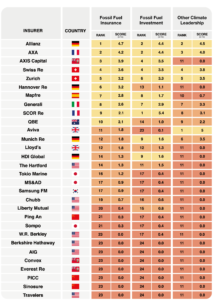

Insuring Our Future: The 2021 Scorecard on Insurance, Fossil Fuels and Climate Change, focuses on 30 of the world’s top insurers. It is published by 26 organizations from 14 countries and will be launched today at the COP26 UN Climate Summit in Glasgow.

Insure Our Future’s fifth annual report on the insurance industry’s response to the climate crisis reveals that insurers have lost their leadership role on the topic. The global industry has taken swift action against new coal projects, which have become nearly uninsurable, although major US companies such as AIG and international specialty insurers continue to prop up coal. Reinsurers have started removing coal from their treaties, an important move because insurance laggards may be reluctant to cover existing coal operations if they cannot reinsure them. But the insurance industry is doing almost nothing to prevent the growth of oil and gas production.

So far, only Axa, Generali and Suncorp have adopted policies to stop cover for some or all new oil and gas production projects, although 14 insurers have now restricted cover for tar sands. Numerous insurers from North America, Europe and Asia continue to underwrite the expansion of the oil and gas industry without any restrictions. These include Allianz, Munich Re and Zurich – all founders of the NetZero Insurance Alliance (NZIA), members of which have committed to align their underwriting portfolios with 1.5°C – who between them provide more than 20% of all oil and gas insurance.

Yet the industry’s retreat from coal shows that action can come quickly, with tangible impacts. Since 2017, 35 insurers have withdrawn cover, representing 14.3% of the market for primary insurance and 54.5% of the market for reinsurance, up from 23 insurers with market shares of 12.9% and 48.3% respectively one year ago. Coal companies now face soaring premiums, reduced coverage, and longer searches to f ind insurance.

Divestment has become standard in much of the industry and this scorecard has ceased to track it. As of last year, more than 65 insurers with combined assets of $12 trillion had divested from coal or pledged to make no new investments, and many have also divested from tar sands. However, Swiss Re and Munich Re are the only insurers that have taken initial steps to phase out investments from oil and gas more generally.

European and Australian insurers continue to set the pace on coal, but East Asian insurers are starting to withdraw support. The US now hosts the last big group of insurers without any coal restrictions, and no companies made new commitments this year. This undermines the Biden administration’s efforts to accelerate the phase-out of coal.

Since the Paris Agreement, the preconstruction coal pipeline has collapsed by more than three-quarters to 297 gigawatt’s (GW), and China’s pledge in September to stop building new coal power plants overseas will end construction in much of the world. The insurance industry must now accelerate the phase-out of existing coal operations and initiate broad momentum away from oil and gas.