Sompo joins NZIA, but must meet new Race to Zero Criteria

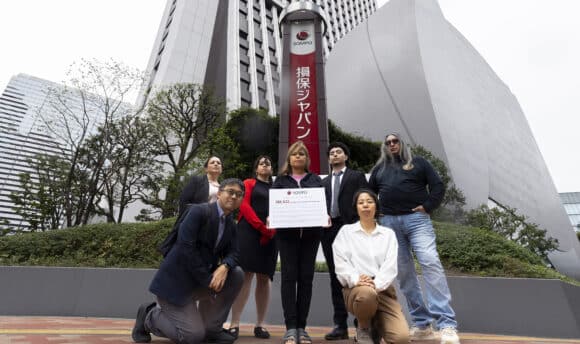

Today, a day after its Annual General Meeting, Sompo, one of the top three Japanese non-life insurers, became the first Asian insurer to rule out insurance and investment in coal companies and companies involved in energy exploitation in the Arctic National Wildlife Refuge. Sompo committed to rule out underwriting and investment in coal companies without transition plans by 2025. (1)

However, Sompo’s policy is silent on how it plans to evaluate the credibility of transition plans at coal companies and fails to mention oil and gas. Sompo must strengthen the transition plan requirement to close all coal-related assets by 2030 in EU/OECD countries and by 2040 globally to align with science based pathways such as the International Energy Agency (IEA) Net Zero scenario and the One Earth Climate Model (OECM) Decarbonization Pathway.(2)

In addition to its strengthened coal commitment, Sompo announced its new membership in the Net-Zero Insurance Alliance (NZIA), which is part of the Glasgow Financial Alliance for Net Zero (GFANZ). The GFANZ are in partnership with the UN-backed Race to Zero campaign which recently updated its criteria that applies to its partner initiatives. Most importantly, the new criteria requires all members to:

- “…phasing down and out all unabated fossil fuels as part of a global, just transition.” (Starting Line criteria, “Pledge”).

- “…restrict the development, financing, and facilitation of new fossil fuel assets in line with appropriate scenarios (Refer to the definition in the “Interpretation Guide, “Pledge”, 4”). Across all scenarios, this includes no new coal projects.” (Interpretation Guide, “Pledge”, 5.b).

- ”Within 12 months of joining, publicly disclose a Transition Plan, City / Region Plan, or equivalent which outlines how all other Race to Zero criteria will be met, including what actions will be taken within the next 12 months, within 2-3 years, and by 2030.” (Starting Line criteria, “Plan”).

All GFANZ members, including the three major Japanese insurance companies, Sompo, Tokio Marine and MS&AD, need to align with this new criteria by June 15, 2023.

"Sompo is the first Japanese financial institution to restrict coal-related companies, while other major financial institutions have project-based exclusion policies only. We welcome Sompo's pioneering efforts and would like to urge other financial institutions to urgently develop policies at the same level or higher.”

"Sompo’s enhanced coal policy is a statement that the company is serious about its net zero commitment unlike its Net Zero Insurance Alliance peers, Tokio Marine and MS&AD, who continue to drag their feet on coal. The UN-backed Race to Zero campaign has made it clear that you can’t commit to net zero while continuing to support the development of new fossil assets. We urge all Asian insurers to enhance their fossil fuel policies in line with the global standard.”

Last month, on 27 May, Sompo updated its climate policy ruling out new tar sands projects and energy explorations in the Arctic Refuge, but not covering the vast majority of other oil and gas projects. Sompo, Tokio Marine and MS&AD must follow their 10 global peers who committed to ban or restrict underwriting oil and gas projects.

Climate, energy and environment ministers from the Group of Seven countries on 27 May issued a communique and committed to end public finance for fossil fuels by the end of 2022. This commitment was followed by the Japanese Government’s announcement to stop providing yen loans for the coal power plants, the Indramayu plant in Indonesia and the Matarbari plant in Bangladesh on 23 June, as a result of increasing pressure from climate NGOs and participating countries. This global movement will keep demanding Japan to take further actions to end its support for coal industries. Tokio Marine, MS&AD and Sompo, should follow this movement and close loopholes and phase-out of coal from their portfolios.

Notes

(1) Sompo sets the definition of a coal company as following; 1) a company with more than 30% of its revenue coming from coal power plants, coal minings or oil sand minings, or 2) an electronic power utility with more than 30% of its electricity generated with coal.

(2) There is also an implication for a coal company screening threshold. According to Urgewald, a 30% threshold will only include about a half coal power plants. A 20% threshold or an absolute threshold is recommended to cover coal companies with large impacts on our climate.