A delegation of community leaders from Rio Grande Valley, Texas, USA visited Japan to meet with insurers and banks supporting liquified methane gas (LNG) projects in the Rio Grande Valley.

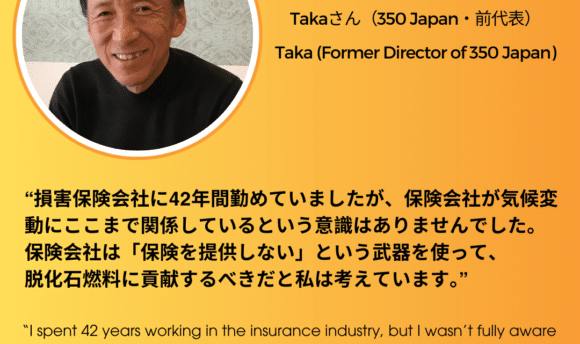

Delegation members at the press conference (Photo credit: RAN / Masaya Noda)

In South Texas, three major LNG projects are under development: NextDecade’s Rio Grande LNG, Glenfarne’s Texas LNG, and Enbridge’s Rio Bravo Pipeline. While local communities, including the Carrizo/Comecrudo Tribe of Texas, actively resist the proposed LNG expansion, the projects have been advanced without the Free, Prior, and Informed Consent (FPIC) required by the United Nations. If built, these LNG terminals will destroy the sacred lands or sacred ancestral burial sites such as “Garcia Pasture” of the Carrizo/Comecrudo Tribe and likely cause severe consequences on the ecosystem, economies, and health of the local communities.

Several major Japanese companies have been identified as key supporters of Rio Grande LNG, with MUFG and Mizuho providing financing and SOMPO providing insurance.

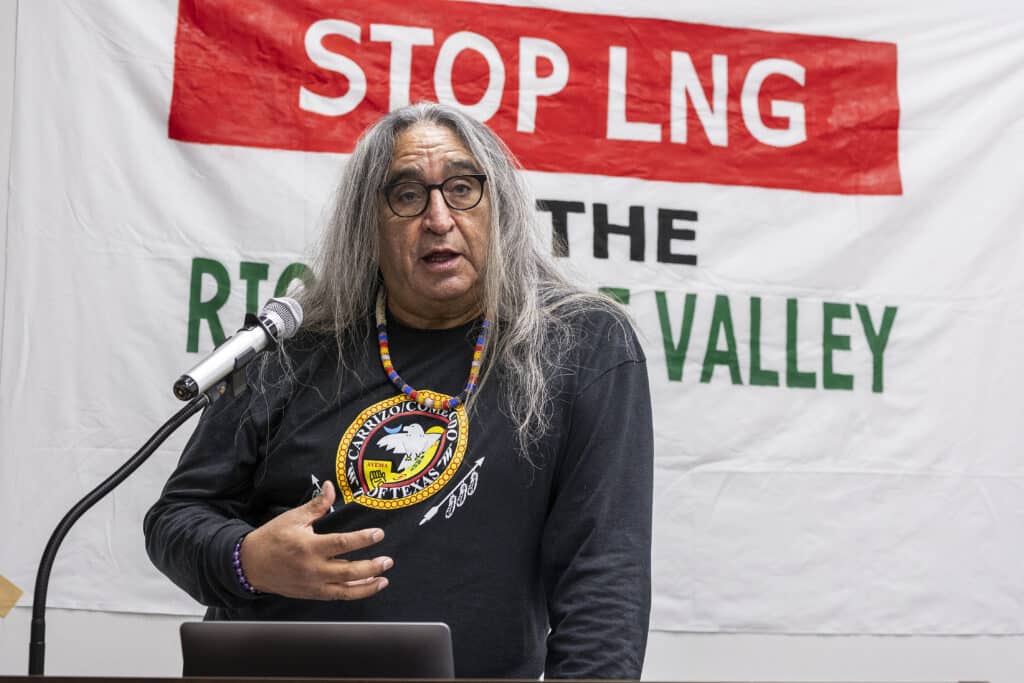

“These companies are trying to occupy this land — all for fossil fuel riches. These projects will ruin our air, pollute our water, and desecrate our ancestral lands. They want to destroy this land — but to do that they will have to destroy our people. And we won’t allow that. We won’t be intimidated anymore.”

– Juan Mancias, Tribal Chair, Carrizo/Comecrudo Tribe of Texas (Statement from RAN press release)

Mancias at press conference (Photo credit: RAN / Masaya Noda)

The delegation addressed concerns at a press conference hosted by the Foreign Correspondents’ Club of Japan. They also held direct meetings with MUFG and SOMPO, urging them to withdraw their support for the Rio Grande LNG project.

The delegation at SOMPO at its Tokyo office. (Photo credit: RAN / Masaya Noda)

SOMPO has faced scrutiny as a major insurer of the Rio Grande LNG project. In June 2024, Insure Our Future submitted a joint petition urging SOMPO to cease underwriting the project. We also sent a request letter to 50 shareholders of SOMPO in August, along with Japan Center for a Sustainable Environment and Society (JACSES), Friends of the Earth Japan, Mekong Watch, Rainforest Action Network, urging them to encourage SOMPO to stop underwriting new fossil fuel projects including Rio Grande LNG project.

The continued efforts of community members and activists have led to key wins, including the Swiss American insurer Chubb dropping insurance coverage for Rio Grande LNG. In August 2024, a U.S. federal appeals court removed the Federal Energy Regulatory Commission’s authorization of Rio Grande LNG, Texas LNG, and the Rio Bravo pipeline, citing inadequate analysis of air pollution and environmental justice impacts. This ruling also resulted in NextDecade to cancel the carbon capture and storage (CCS) component of the Rio Grande LNG project.

In addition to environmental risks and Indigenous rights issues, these LNG projects pose high economic risks, likely affecting the insurers and banks supporting the project. Prior to Chubb’s withdrawal, major banks Societe Generale and BNP Paribas, have also pulled out of these projects.

In October 2024, Rainforest Action Network, South Texas Environmental Justice Network, and the Carrizo/Comecrudo Tribe of Texas jointly released a Risk Report, revealing the risks for the companies supporting the project. The following summarizes the key points listed in the report.

Economic Risks

NextDecade originally planned to reach a final investment decision (FID) in 2017, with operations scheduled to begin in the fourth quarter of 2020. However, due to factors including the company’s inadequate regulatory response, litigation, opposition from local residents, and instability in the oil and gas market, the project has faced repeated delays.

In their 2023 Annual Report, the company commented:

“The substantial amount of indebtedness incurred to finance construction of Phase 1 of the Rio Grande LNG Facility may adversely affect Rio Grande’s cash flow and its ability to operate its business, remain in compliance with debt covenants and make payments on its indebtedness.”

NextDecade is not the only company facing economic issues with LNG projects. ExxonMobil and Qatar Energy recently announced a three-year delay in their Golden Pass LNG terminal due to the bankruptcy of Zachry Holdings, their lead contractor.

Furthermore, the Institute for Energy Economics and Financial Analysis (IEEFA) warns of a potential global LNG oversupply within two years. While Japan, South Korea, and Europe currently account for more than half the demand for LNG, the total imports will likely continue to fall. Such market conditions may lead to a prolonged period of low prices and no profits, posing significant risks to insurers and financial institutions involved in LNG projects.

Emissions Risks

According to a report by Private Equity Climate Risks, the new terminals created as part of the LNG expansion have the potential to emit 96 million tons of CO2 annually – equivalent to the emissions from 242 natural gas-fired power plants.

While developers claim that LNG is a “bridge fuel” to decarbonization, studies suggest that LNG may cause more serious impacts than coal. It was revealed that LNG’s climate impact could be up to 24 times greater than coal, with its entire lifecycle taken into account.

Pollutant emissions are another pressing concern. Emissions from LNG facilities, including methane, benzene, and Volatile Organic Compounds (VOCs), pose serious threats to respiratory health, fetal development, and cancer risk. These impacts can be life-threatening issues for the members of local communities, especially low-income families of color, where access to healthcare is often limited.

Members of the Rio Grande Valley delegation. (Photo credit: RAN / Masaya Noda)

The delegation’s meeting with SOMPO was conducted respectfully, and we welcome the company’s willingness to engage in discussion.

However, as highlighted by multiple reports, the risks associated with LNG projects extend beyond local communities to the companies providing financial and insurance backing.

We urge SOMPO, as well as the other insurers underwriting the projects, to reassess the economic, environmental, and reputational risks of the projects and reconsider their involvement.

References

- Rainforest Action Network, Carrizo/Comecrudo Tribe of Texas, and South Texas Environmental Justice Network, “Rio Grande Valley At Risk from Methane Gas Export Terminals,” October 2024.

- NextDecade Corporation, “Annual Report to Stockholders for the Year Ended December 31, 2023”.

- Shafiqul Alam, et.al., “Global LNG Outlook 2024-2028,” IEEFA, April 25, 2024.

- Private Equity Climate Risks, “Private Equity’s Role in US Liquefied Natural Gas Emissions,” March 28, 2024.

- Robert W. Howarth, “The Greenhouse Gas Footprint of Liquefied Natural Gas (LNG) Exported from the United States,” August 27, 2024.

- Natural Resources Defense Council, “Sailing to Nowhere: Liquefied Natural Gas is Not an Effective Climate Strategy,” December, 2020.