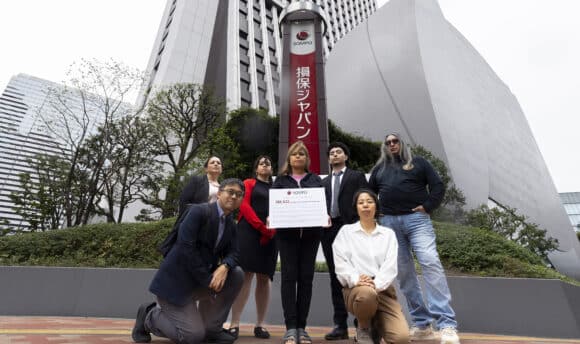

2024 Global Insurance Company Rankings on Fossil Fuel Policies: Tokio Marine and MS&AD Overtake SOMPO

Japan Center for a Sustainable Environment and Society (JACSES)

The Insure Our Future campaign (*1), an international network of environmental NGOs, released its 2024 annual scorecard (*2). The scorecard assesses 30 major global insurance companies based on their fossil fuel exclusion policies, ranking them based on their performance. Among Japan’s leading non-life insurers, Tokio Marine Holdings, Inc. (Tokio Marine) and MS&AD Insurance Group Holdings, Inc. (MS&AD) tied for 15th place, and SOMPO Holdings, Inc. (SOMPO) ranked 17th. While SOMPO was the first among Japan’s top three non-life insurers to announce a policy restricting underwriting for coal businesses, MS&AD and Tokio Marine came in for higher positions as they strengthened their targets and policies since the previous year.

Globally, Italy’s largest insurer Generali rose to first place, surpassing Germany’s Allianz. Generali became the first insurer to announce an end to insuring oil and gas expansion, including new LNG terminals. This makes it the first insurer globally to stop underwriting across the entire oil and gas value chain. In addition, 25 out of the 30 companies evaluated in this year’s scorecard have adopted some form of restriction on underwriting oil and gas projects. For upstream oil and gas extraction projects, all 11 major European insurers except Lloyd’s have introduced policies to rule out new oil and gas extraction.

The scorecard report also analyzes global insurers’ trends for underwriting fossil fuel projects and their claim payments for climate-related disasters. In 2023, the top 28 insurers saw annual damages from climate-related events reach 10.6 billion USD, nearly equaling the 11.3 billion USD in insurance premium income from fossil fuel projects. For 15 companies, the damages exceeded the income from fossil fuel underwriting. Insurers are passing the burden of increased damages onto the public by raising premiums on non-life insurance, leading to paradoxical situations where those most affected by climate disasters are no longer covered by insurance.

In Japan, in November 2023, MS&AD became the first insurance company in Asia to announce a mid-term target for reducing greenhouse gas emissions from its underwriting portfolio. According to MS&AD, the 37% reduction target was “calculated based on the greenhouse gas emissions target for 2030 and the reported total emissions for 2019 as stated in Japan’s Nationally Determined Contribution (NDC)”. However, this is not adequate as Japan’s NDC was rated by Climate Action Tracker, as not aligning with the Paris Agreement’s 1.5°C target (*3). MS&AD must revise this target to at least 43% (*4) to be consistent with the 1.5°C goal, and expand the scope to include global clients.

In March 2024, Tokio Marine announced a new policy under which Tokio Marine & Nichido Fire Insurance Co., Ltd. would engage with 60 companies with high greenhouse gas emissions to encourage their development of decarbonization targets. Businesses with companies that fail to formulate such plans would be ceased, according to the announcement. While this is a step forward, the policy lacks concrete requirements for the decarbonization targets, and fails to ensure alignment with the Paris Agreement’s 1.5°C target (*5). Furthermore, the policy would not apply to overseas subsidiaries.

Tokio Marine is also suspected of underwriting the East African Crude Oil Pipeline (EACOP), which has drawn global criticism for a number of reasons, including escalating climate change, environmental destruction, and human rights violations. Many other banks and insurers distanced themselves from EACOP, including three major Japanese banks stepping back from the project and 29 insurance companies, including Zurich, AXA, Allianz, and Munich Re, denying their involvement.

SOMPO also updated the scope of its underwriting policy in June 2024, broadening its exclusion list for coal businesses. The exclusion area for energy extraction projects was also expanded, from the current Arctic National Wildlife Refuge (ANWR) to include the Arctic Monitoring and Assessment Programme (AMAP) region (*6). Meanwhile, SOMPO’s requirement for GHG reduction plans from major coal businesses does not mandate alignment with the 1.5°C target, and leaves the possibility for underwriting energy extraction projects in the Norwegian Sea in the AMAP region.

SOMPO has also been confirmed as underwriting the Rio Grande LNG, a project criticized for failing to obtain Free, Prior, and Informed Consent (FPIC) from the local indigenous communities. Other insurers and banks, including Sumitomo Mitsui Banking, Société Générale, Credit Suisse, and Chubb announced their withdrawal from the project.

Japanese insurers, including Tokio Marine, SOMPO, and MS&AD, must take prompt actions to:

- Develop comprehensive policies to cease underwriting of oil and gas projects,

- Establish and strengthen policies for divestment from fossil fuel-related companies

- Formulate policies that incorporate FPIC

- Set and strengthen GHG reduction targets for their underwriting portfolios

Notes:

*1: The Insure Our Future campaign is an international network formed by 19 organizations including JACSES, 350.org, and The Sunrise Project, whose mission is to call on insurers to cease underwriting and investing in fossil fuel businesses. The publication of annual scorecards began in 2017.

*2: The Japanese version (PDF) is available for download [here]. English version available at:

https://global.insure-our-future.com/scorecard-2024-insurers-climate-losses/

*3: https://climateactiontracker.org/countries/japan/policies-action/

*4: https://www.ipcc.ch/report/ar6/wg3/

*5: For details, see the press release: https://jacses.org/2364/

*6: https://www.sompo-hd.com/csr/system/vision/